PCLaw was the first program for trust accounting that I learned. I am a certified consultant, and have extensive experience dealing with all the issues and questions with the program that new clients come to us with.

Many times, we hear lawyers say that their trust is up to date and that their bookkeeper saved all of the monthly reconciliation reports. However, the unsettling truth is that while the reports may seem balanced at a first glance, there can be many hidden errors that can become big problems in LSO audits.

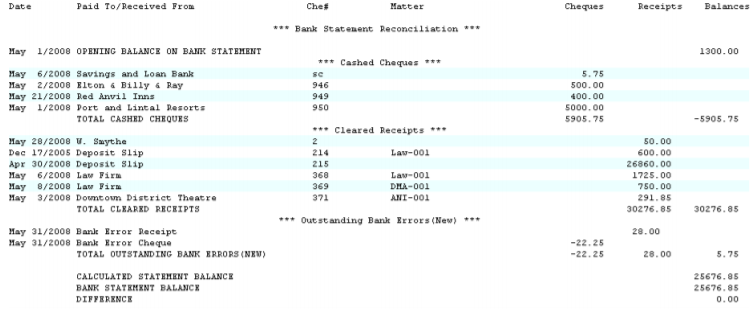

As an example, let us look at the following example from lexisnexis.com. We started with a bank balance of $1,300 – we then deducted $30,276.85 in cheques, added $5,905.75 of receipts, and added bank errors. We ended with a matched balance of $25,676.85 and the report looks accurate.

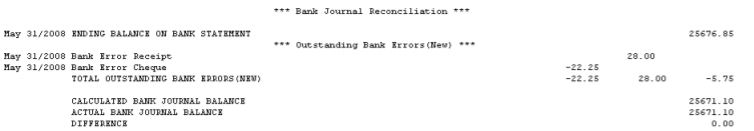

However, when we delve deeper into the bank journal reconciliation, this is where programs can begin to surface.

Under the trust error section, attention needs to be paid as to when the errors occurred. By law, all trust errors need to be fixed the next month – so any errors from the month before, or even longer, need to be dealt with as soon as possible.

The outstanding cheques section must also be scrutinized, as any cheque outstanding for over six months could be stale dated – at this point, the firm needs to follow up with the vendor/client associated with the cheque.

Outstanding deposits are another area that requires acute attention to detail. The golden rule for trust deposits is that once you receive trust funds, you should deposit them by the end of the next banking day. As such, the only outstanding deposits on the report should be at the very end of the month, and we should expect to see them as the first deposits of the next month’s bank statements.

I hope this short case study was insightful. Still confused? Don’t worry, our team of highly skilled and experienced individuals are here to help you with all of your legal bookkeeping needs. Contact us today for further inquiries.