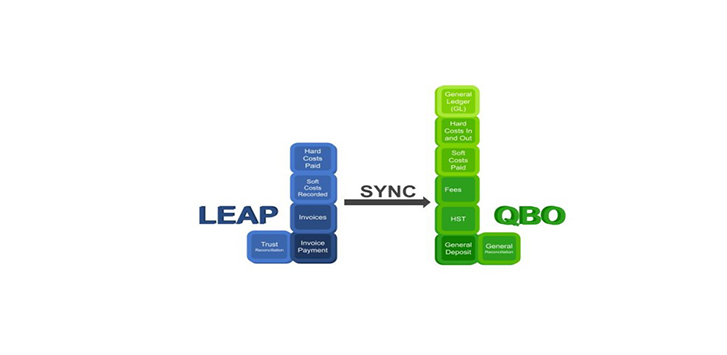

—- Leap is looking after trust, invoices and payments, and client disbursements. The transactions from Leap are synchronized with Quickbooks Online through Journal entries. Quickbooks Online (QBO) produces general reconciliation, monthly and year-end financial reports, and CRA-obliged filings. —-

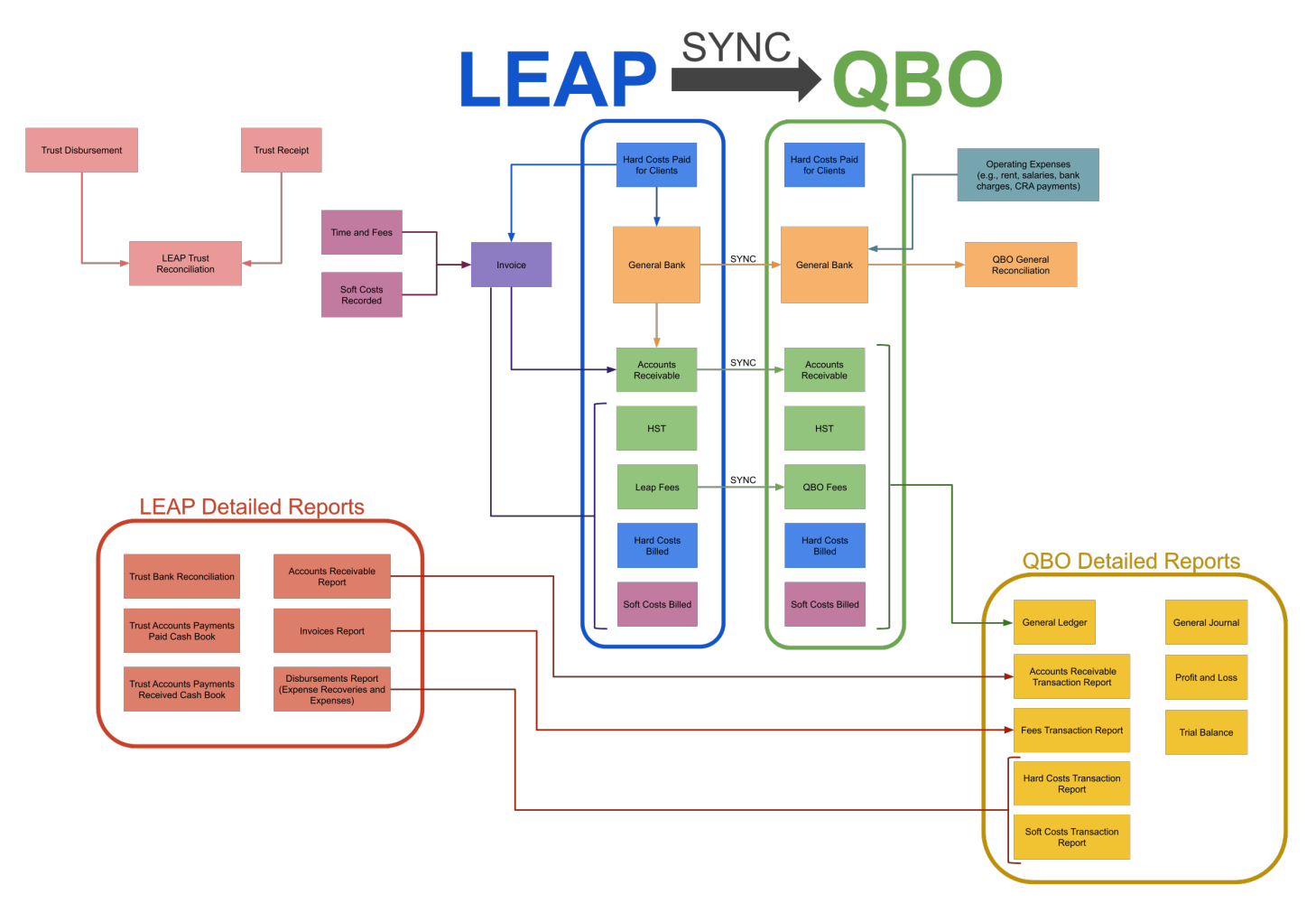

- When a hard cost client disbursement (where the filing fee is paid to Minister of Finance) is made by general banking or visa in leap, the banking and hard cost accounts in QBO are updated.

- When a soft cost (expense recoveries like photocopies) is recorded in Leap, nothing is synced into the financials in QBO until it is billed.

- Both hard cost and soft cost are tracked in Leap on a matter basis where they can be reviewed and billed by the “Create Invoice” function.

- When a bill is made in Leap from time/fees and client disbursement, a journal entry with Fees, HST, and accounts receivable are synchronized into these three accounts in QBO. If the client disbursement is a hard cost, it will affect the hard cost account receipt account in QBO. On the other hand, if the client disbursement is a soft cost, it will go directly into the other income: soft cost.

- This is the flow of all the detailed postings in Leap. Client related banking transactions are easily matched to all the related banking feeds.

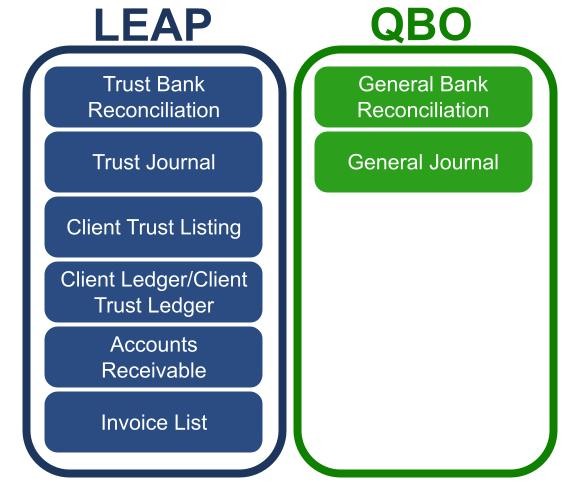

At the month end, Law Society compliance reports are produced as seen in this chart:

We consider Leap and Quickbooks Online together as a “perfect marriage”!